A long-standing commitment to sustainable development

Our commitment to sustainable development is evidenced by our long-standing participation in international initiatives, such as:

- the UN Global Compact

- the United Nations Environment Programme Finance Initiative

- the Diversity Charter of the Institut Montaigne

- the UN Principles for Responsible Investment (PRI)

- the Carbon Disclosure Project (CDP)

- the UNEP-FI Declaration on Financial Capital

- the Global Investor Statement on Climate Change

- the Montreal Carbon Pledge

- the Net Zero Asset Owner Alliance

An ongoing dialogue with our stakeholders

Our SER steps only make sense if they meet society’s expectations. This is why we build our policy on the basis of a close, regular and constructive dialogue with our main stakeholders. We favour a collaborative approach which, for some specific projects, can lead to the creation of sustainable offers.

In order to incorporate our stakeholders’ opinions into our strategies, a stakeholders’ committee has been set up at the Group level to influence our choices towards sustainable development and to use high-level expertise. Our CEO and members of the Executive Committee are present when this committee meets in order for recommendations to be directly communicated to the highest level.

Through our reporting, we go to great lengths to provide a response to the issues about which we care most.

Integrated and consolidated reporting across the Group

Since 2001, Caisse des Dépôts has voluntarily reported on its extra-financial performance. As a key step in our social responsibility, reporting is a tool that improves our performance and is part of our commitment to be transparent with our stakeholders. Quality reporting is essential to managing our performance, identifying areas where we need to be more vigilant and reporting on our contribution to society by striving to increase our positive impact over time.

Our aim is to provide clear and comprehensive reporting that provides an overall view of our strategy and organization as well as the positive and negative impacts of our activities. To this end, we have carried out a materiality assessment and, since fiscal year 2018, we have been adding to it with an analysis of our non-financial risks. This risk analysis, the control mechanisms in place to respond to risks, and the associated performance indicators are revised annually with a view to incorporating them into the Group’s global risk management process.

Our Activity and Sustainable Development Report presents the Group’s highlights over the last year. It sets out our model and our core activities, our commitments as a responsible actor and our global performance by giving a structured presentation of our control over our main extra-financial risks and our plans to contribute to the SDGs. While our main extra-financial risks are presented in our annual Activity Report, the other relevant risks with regard to our activities are set out in the Responsible Investment Report as well as in our supplement, which brings together the whole of the Group’s environmental, social, societal and governance data.

These publications are part of our voluntary approach to publishing extra-financial reports in accordance with French legislation on the declaration of extra-financial performance. They also meet the reporting requirements set out in article 173.6 of the French law relating to energy transition for green growth and the United Nations Global Compact “GC Advanced” table.

Read the reports:

At the same time, some of our subsidiaries independently publish reports with more detailed information about their social, environmental and societal issues:

Recognised performance

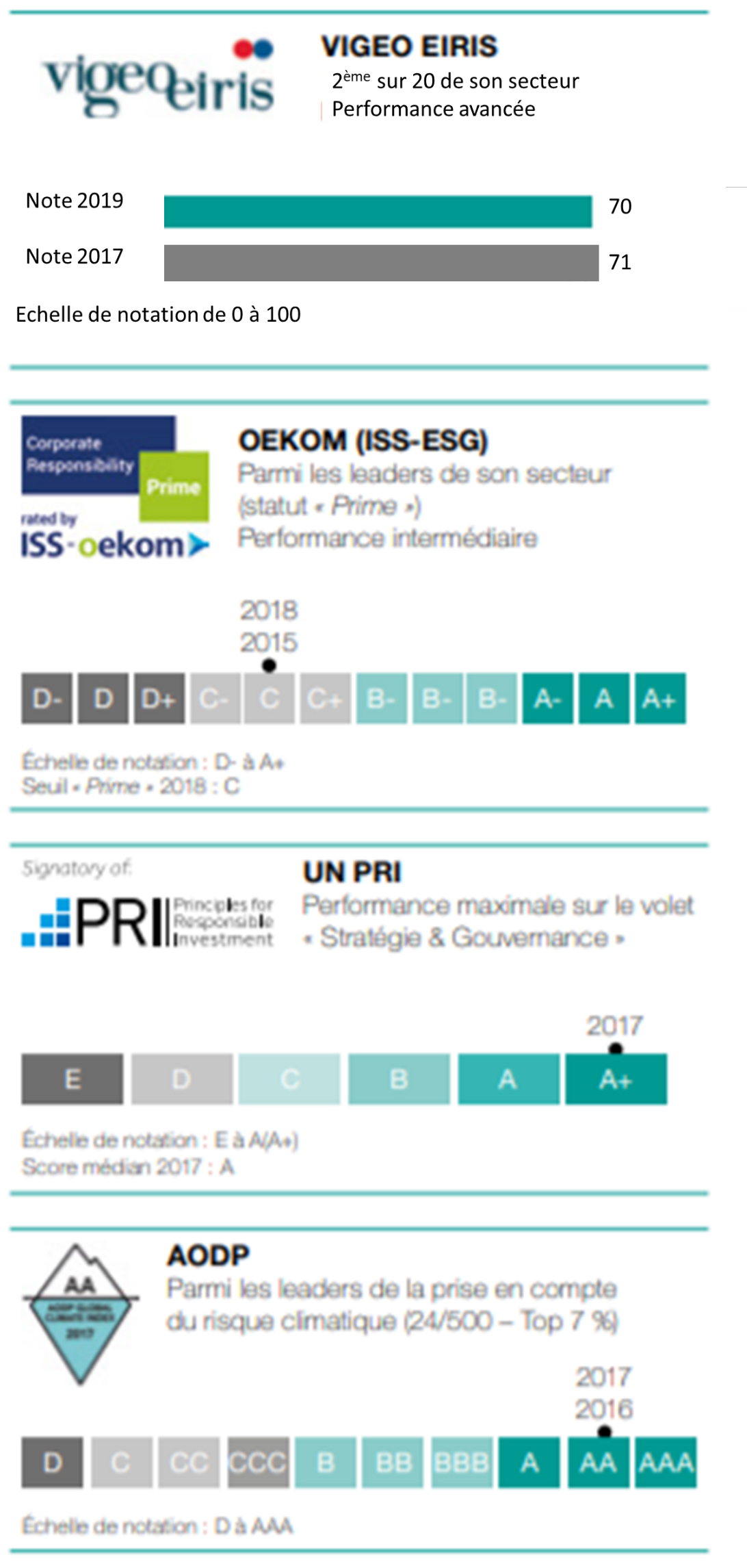

Caisse des Dépôts is assessed approximately every two years by three extra-financial rating agencies: Vigeo Eiris, ISS ESG (e.g. Oekom) and Sustainalytics.

As a signatory to the United Nations Principles for Responsible Investment (UN PRI), we produce an annual report for the PRI organization that evaluates our responsible investment approach.

The non-governmental organization Asset Owners Disclosure Project (AODP) also assesses us each year on our consideration of climate risk in our investment policy.