The Supervisory Board

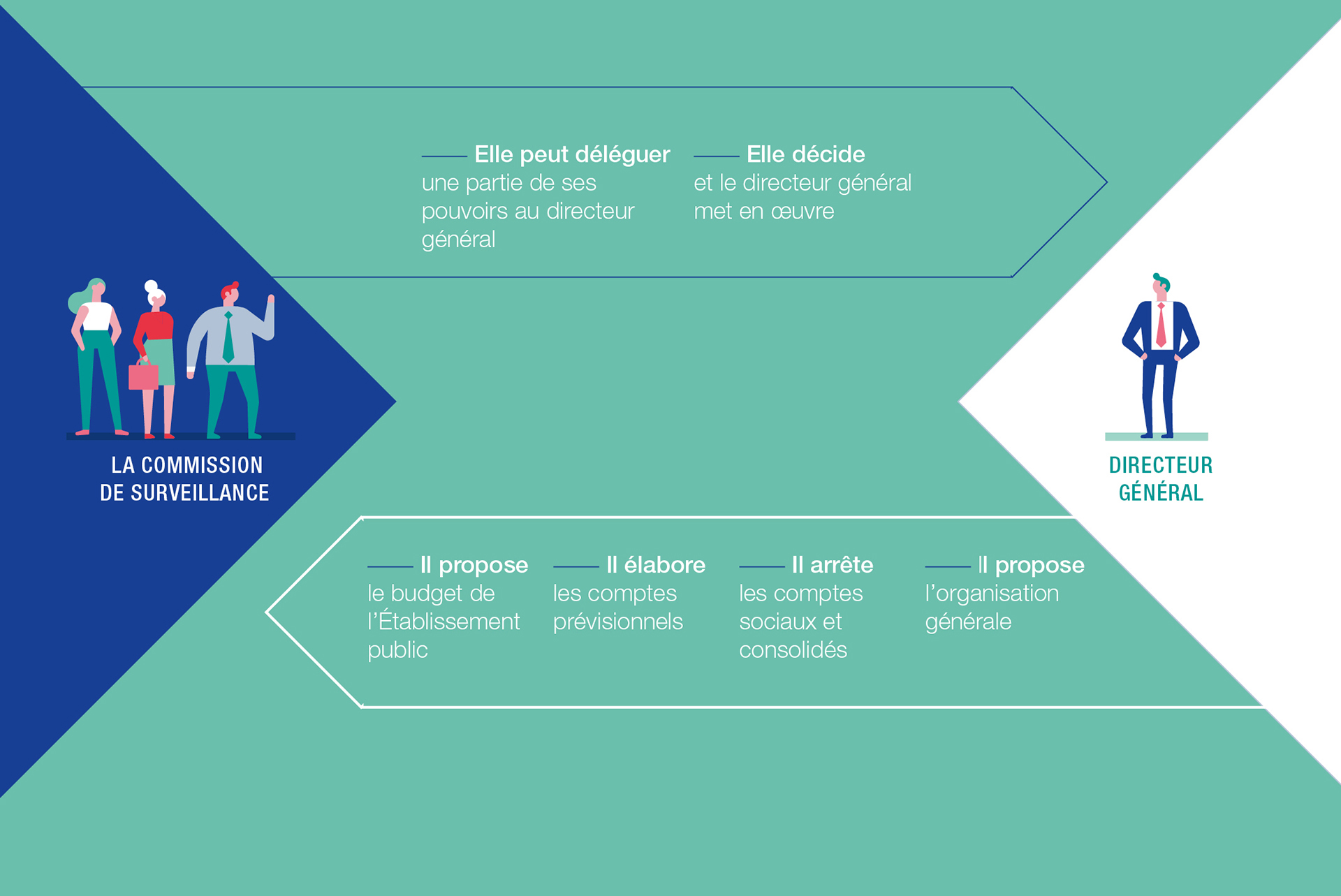

Since the creation of Caisse des Dépôts, the role of the Supervisory Board has been to oversee the proper management of the Group and the decisions of the Chief Executive Officer.

It is chaired by a Member of Parliament who, at least once a year, reports the work carried out back to Parliament through a report about Caisse des Dépôts’ debates and opinions.

Three founding texts

Placed “in the most special way, under the control and protection of the legislative authority” by the Law of 1816, Caisse des Dépôts is the only European financial institution able to avail itself of national protection.

The Law for the Modernization of the Economy of 4 August 2008 increased Caisse des Dépôts’ powers by placing the mutual savings fund under its control and by allowing it to give its opinion on the strategies of the public institution and its subsidiaries, the missions carried out in the public interest, the general financial situation and the Group’s accounts.

More recently, the Pacte Law of 22 May 2019 further increased Caisse des Dépôts’ role by transforming the Supervisory Board into a deliberative body. It can now adopt the institutional budget, deliberate on the risk management strategies of the public institution and its subsidiaries, and approve company accounts and consolidated financial statements.

Structure of the Supervisory Board :

The Pacte Law modified the structure of the Supervisory Board, increasing its number of members from 13 to 16. The role of Members of Parliament has been maintained (three deputies and two senators), while the number of people appointed by the Parliament increased from three to five. Furthermore, two representatives from the staff of Caisse des Dépôts will now be present. Lastly, the State is now represented by the Director General of the Treasury, or her representative, and appoints three people. From now on, the rule of gender equality must be respected.

The Supervisory Board is also supported by a General Secretariat.

Since 2003, the Supervisory Board has had internal rules of procedure that set out its rights, resources and its interaction with the Chief Executive Officer. These rules also set out the role of the specialized committees set up within the Supervisory Board to strengthen its analytical and supervisory capacity:

- The Audits and Risks Committee

- The Savings Committee

- The Investments Committee

- The Appointments and Compensation Committee

- The Strategy Committee

- The Social and Environmental Responsibility and Ethics Committee (CSR and Ethics).

-

Anne-Laurence Petel

Deputy for the 14th district of Bouches-du-Rhône

Crédit ©Frederique PLAS

-

Marc Le Fur

Deputy for the 3rd district of Côtes-d'Armor

Crédit ©Frederique PLAS

-

Arnaud Bazin

Senator for Val-d'Oise

Crédit ©Sénat

-

Viviane Artigalas

Senator for Hautes-Pyrénées

Crédit ©Frederique PLAS

-

Gabriel Cumenge

Assistant Director of Trésor executive management, Chief Executive Director représentative at Trésor

Crédit ©Frederique PLAS

-

Emmanuelle Auriol

Economics teacher (qualified person appointed by the President of the French National Assembly)

Crédit ©Frederique PLAS

-

Qualified person appointed by the President of the National Assembly pending appointment

To be nominated

-

Denis Duverne

Honorary civil administrator, qualified person appointed by the President of the French National Assembly

Crédit ©Frederique PLAS

-

Jean-Yves Perrot

Senior judge at the Court of Auditors (qualified person appointed by the President of the French Senate)

Crédit ©Frederique PLAS

-

Evelyne Ratte

Honorary President of the Chamber of the Court of Auditors (qualified person appointed by the President of the French Senate)

Crédit ©Frederique PLAS

-

Jean-Marc Janaillac

Qualified person appointed by the State

Crédit ©Frederique PLAS

-

Marie-Claire Capobianco

Qualified person appointed by the State

Crédit ©Thomas Lainé/La Company

-

Qualified person appointed by the State (to be nominated)

To be nominated

-

Pierre Fourcail

Staff representative at Caisse des Dépôts

Crédit ©Frederique PLAS

-

Béatrice de Ketelaere

Staff representative at Caisse des Dépôts

Crédit ©Frederique PLAS

The Strategy Committee

The Chief Executive Director presides over the Executive Committee, which is the main governance body of Caisse des Dépôts. Following parliamentary approval, the President of the French Republic appoints the CEO for a period of five years.

Upon taking office, the CEO swears before the Supervisory Board to preserve the integrity of Caisse des Dépôts.

The Executive Committee, which the CEO presides over, is the main governing body of Caisse des Dépôts.

Its structure reflects the five areas that represent the core of the Group’s activities:

- Supporting regional projects.

- Financing companies through our joint subsidiary with the State, Bpifrance.

- Pensions and professional training.

- Asset management.

- Monitoring subsidiaries and shareholdings.

In addition to these, the support departments essential for us to carry out these activities.

The CEO decides our strategy, monitors the operational performance of Caisse des Dépôts and ensures that the services offered meet client, partner and user needs.

-

Olivier Sichel

Executive Vice-President of Caisse des Dépôts and Director of Banque des Territoires

Crédit © Frédérique Plas – Caisse des Dépôts – 2019

-

Nicolas Dufourcq

Executive Director of Bpifrance

Crédit © Frédérique Plas – Caisse des Dépôts – 2019

-

Catherine Mayenobe

Director of Operations and Business Transformation Management

Crédit © Frédérique Plas – Caisse des Dépôts – 2019

-

Olivier Mareuse

Director of Assets Management - Director of Saving Funds

Crédit © Frédérique Plas – Caisse des Dépôts – 2019

-

Marianne Kermoal-Berthomé

Directrice des politiques sociales

Crédit Jean Nicholas Guillo / REA - Caisse des Dépôts – 2023.

-

Virginie Chapron-du Jeu

Director of Risks at the Caisse des Dépôts Group

Crédit © Frédérique Plas – Caisse des Dépôts – 2019

-

Pierre Chevalier

Director of Legal Affairs, Compliance and Ethics of the Caisse des Dépôts Group

Crédit © Frédérique Plas – Caisse des Dépôts – 2019

-

Marie-Laure Gadrat

Chief of staff to the Chief Executive Director

Crédit Jean Nicholas Guillo / REA - Caisse des Dépôts - 2023

-

Sophie Quatrehomme

Director of Communication of the Caisse des Dépôts Group

Crédit © Frédérique Plas – Caisse des Dépôts – 2019

-

Aurélie Robineau-Israël

Director of human ressources

Crédit Jean Nicholas Guillo / REA - Caisse des Dépôts - 2023

-

Antoine Saintoyant

Director of Strategic Holdings of the Caisse des Dépôts Group, Vision Groupe Project Manager

Crédit © Frédérique Plas – Caisse des Dépôts – 2020

-

Nathalie Tubiana

Director of Finance and Sustainable Policy

Crédit © Frédérique Plas – Caisse des Dépôts – 2020

-

Michel Yahiel

Director of Social Policies

Crédit © Frédérique Plas – Caisse des Dépôts – 2019

Find out how our governing structure works