Sfil Group has launched its 1st green transaction of 2023 under covered bond* format Caffil for an amount of €750mn and a maturity of 5 years. The proceeds of this green bond will finance eligible green investments carried out by French local authorities.

With an order book reaching €3.5bn i.e. an oversubscription rate of x4.7, the transaction met with very strong demand from international investors. A total of 115 investors participated in the transaction, and 78% of the issue was allocated to investors with a strong commitment to responsible investment

Read the press release on Sfil’s website and know more

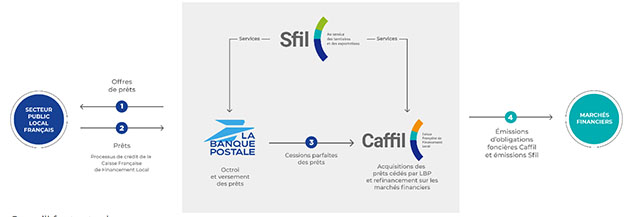

1st mission, financing the French public local authorities (in French):

Crédit © Groupe Sfil

* Covered bonds are debt instruments secured by a cover pool of mortgage loans (property as collateral) or public-sector debt to which investors have a preferential claim in the event of default.