Central to the Group's corporate purpose, the Caisse des Dépôts Group's sustainability policy aims to accelerate its contribution to national and international climate, biodiversity and social and regional cohesion objectives, and ensure that the Group leads by example in all of its activities, all while respecting the environmental and the principles of social well-being.

A longstanding commitment

A pioneer in responsible investment, Caisse des Dépôts has been a signatory to the United Nations Global Compact and the Principles for Responsible Investment (PRI) since they were drawn up, in 2000 and in 2006 respectively.

It is also a founding member of the Net-Zero Asset Owner Alliance (NZAOA), formed in 2019, which brings together institutional investors committed to transitioning their asset portfolios to net-zero emissions by 2050.

Integrating sustainability into the Group's overall management

Over the past 20 years, Caisse des Dépôts' continuous commitment has been reflected in cross-cutting policies that are increasingly structured and integrated into the Group’s overall management.

ESG commitments are now factored into all of our activities, including financing, operating activities, risks, accounting and HR.

2000 Became a member of the UN Global Compact

2001 Novethic createdc

2003 Became a member of the United Nations Environment Programme Finance Initiative (UNEP-FI)

2006 Supported the creation of the Principles for Responsible Investment (PRI)

2007 Joined the Carbon Disclosure Project (CDP)

2008 CDC Biodiversité created

2009 Became a member of the French Sustainable Investment Forum (Forum pour l'Investissement Responsable – FIR)

2012 Group Responsible Investment Charter The Caisse des Dépôts Group's first Corporate Social Responsibility report Governance principles for listed companies published Ecotidien CSR programme for internal operations implemented

2015 Climate policy for financial portfolios introduced

2017 Group 2°C alignment roadmap drawn up First green bond issued

2019 SDGs integrated into strategic management First sustainability bond issued Net-Zero Asset Owner Alliance initiated French public investor charter for climate action signed

2020 Recovery plan: €40bn committed over five years to finance the ecological transition in priority sectors Caisse des Dépôts’ biodiversity plan rolled out Climate policy strengthened

2021 The Caisse des Dépôts Group labelled a "Company committed to Nature" Nature Day held New commitments made in the area of fossil fuel divestment and financing for the energy transition

2022

- Group biodiversity policy adopted

- Group Responsible Employer Statement published

- Group-wide climate adaptation action plan drawn up

- Responsible Investment Charter updated and extended to all types of financing

- New Group climate policy adopted

Adhere to and promote the objectives of the Paris Agreement.

Be a resilient Group that drives adaptation.

Be a pioneer in preserving the planet's ecosystems.

Strike a balance between all ESG components.

Prioritise financing with a social and environmental focus.

Prioritising consultation, monitoring and transparency

A Stakeholders Committee, made up of experts, NGOs, local authority and saver associations and SMEs, meets twice a year along with the Chairman and Chief Executive Officer and the Group Executive Committee to review our sustainability policy commitments.

Consolidated sustainability reports are produced at Group level, including in particular:

- A Social Responsibility Report, including the non-mandatory non-financial information statement (NFIS), which presents the sustainability policies, results and impacts of all the Group's activities.

- A Responsible Investment Report, which presents how environmental, social and governance issues are integrated into our investment activities, incorporating the disclosures required under article 29 of the French Energy and Climate Act.

Our approach is based on continuous dialogue with stakeholders and a commitment to transparency.

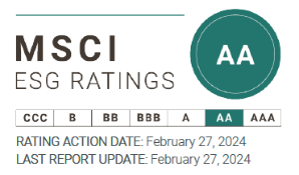

Performance recognised by ESG rating agencies

A +

Highest score

In the “Policy, Governance and Strategy” category

2020

ADVANCED

74 / 100

Ranked first in its sector

2022

C

Prime status

Among industry leaders (top 10%)

2023

Negligible Risk

7.8 / 100

Ranked 14th among global banking institutions

2023

MSCI

AA

2024