FIND OUT MORE:

Notre organigramme

Notre plaquette de présentation du Groupe

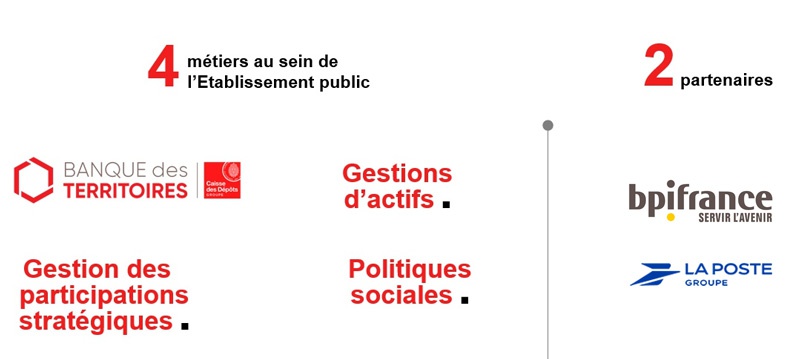

Our four core activities

Asset Management

The Asset Management division manages all of Caisse des Dépôts’ financial investments (bonds, equities, unlisted investments, property, forests, etc.), carried on the balance sheets of the Savings Funds and the Central Sector. As the leading public asset manager (€323bn in assets under management) and the leading investor in listed French SMEs, the division takes a responsible, long-term view and invests in all asset classes, directly or through its subsidiaries (CDC Croissance, Société Forestière and CDC Investissement Immobilier).

FIND OUT MORE: Asset Management Presentation Brochure | Podcast Virage(s) Laureen : Exclure, dialoguer, voter

La Banque des Territoires

Created in 2018, Banque des Territoires supports regions and their stakeholders by offering solutions tailored to local challenges, including advisory, loans and equity investments. With 16 regional departments, 37 local offices and two subsidiaries, CDC Habitat and SCET, it offers a comprehensive range of engineering and project structuring services to local authorities, social housing organisations, local public companies, legal professions, businesses and financial players, with the aim of working towards more sustainable and socially responsible regions.

FIND OUT MORE: Visit the website

Banque des Territoires’ broad-ranging expertise and financing capabilities are also leveraged by its network of regional departments across mainland France and the overseas territories.

FIND OUT MORE: Les directions régionales de la Banque des Territoires

Social Policy division

Caisse des Dépôts' Social Policy division supports French people throughout their lives.

As a trusted third party, it contributes to social cohesion and reducing regional divisions by working mainly in four areas: pensions, vocational training, disability, and elderly care and healthcare. The Social Policy division manages 66 funds and mandates and is the partner of choice for 55,000 public sector employers, providing reliable and innovative solutions to its customers and public authorities.

FIND OUT MORE: Visit our website

Management of Strategic Investments

The Strategic Investments division oversees acquisitions and disposals as well as shareholder management for some 20 companies in which Caisse des Dépôts is the reference shareholder. It helps to define CDC's share ownership position and to provide strategic and financial support to its subsidiaries, while coordinating priorities between the Group and its subsidiaries. A long-term investor, CDC supports the development of its subsidiaries – whose earnings support public‑ interest missions – over the long term.

FIND OUT MORE: Découvrez notre plaquette de présentation | Nos équipes vous présentent la gestion des participations stratégiques

Our two strategic partners co-owned with the French State

Bpifrance and La Poste group, which the Group owns alongside the French State, have a unique positioning and are considered strategic partners.

Bpifrance

Bpifrance is a public investment bank owned by Caisse des Dépôts and the French State. Its purpose is to boost the French economy and make it more competitive through support for public policy. It finances companies at each stage of their development, through loans, guarantees and equity. As a trusted partner to entrepreneurs, it provides advice, training, networking and an acceleration programme for start-ups and small and medium-sized companies.

FIND OUT MORE: Accédez au site Bpifrance

La Poste

group

Majority-held by Caisse des Dépôts Group since 2020, with the French State as its other shareholder, La Poste group serves the French people by offering useful services adapted to their needs. Through its four public service missions (universal postal service, accessible banking, regional development, and press transport and delivery), it supports the major ecological, regional, demographic and digital transitions that are impacting society.

FIND OUT MORE: Accédez au site du Groupe La Poste

Through its subsidiaries operating in the competitive sector in France and abroad, the Caisse des Dépôts Group brings together a range of specialists in a wide variety of sectors as part of its financial activities, including business support and development, personal insurance, housing and real estate, sustainable mobility, engineering, energy and the environment.

FIND OUT MORE: Découvrez nos filiales