On 22 July, Bpifrance successfully launched its second green bond due 29 November 2027 for an amount of €1.25bn, offering a re-offer yield of 2.149%. The proceeds of the transaction will be entirely dedicated to financing or refinancing wind and solar projects in France.

The issuance received solid support from investors with a final order book in excess of €2.1bn.

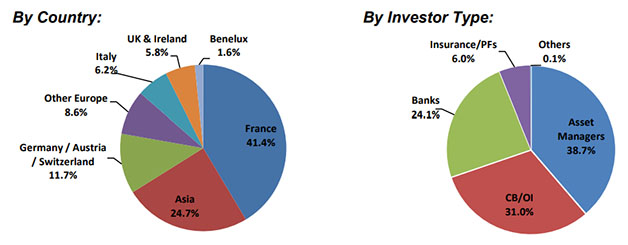

The transaction benefited from diversified investor participation, dominated by Asset Managers (39%), CBs/OIs (31%) and Banks (24%). The geographic breakdown highlights a strong pan-European support, represented mainly by France (41%), Germany/Austria/Switzerland (12%), Italy (6%) and UK & Ireland (6%). Outside Europe, it was noticeable the participation from Asian investors (25%).

Crédit © Bpifrance

The bond issue is part of the 2020-2024 joint Climate Plan of nearly €40bn launched by Banque des Territoires and Bpifrance in September 2020.

Bpifrance is a key stakeholder of French SMEs ecological and energy transition, being a historical player in the green transition. This bond issue is in line with the long-term strategy of Bpifrance, the climate bank for French entrepreneurs.

To find out more about the conditions of the issue, access the press release