Caisse des Dépôts issued a new sustainable bond, its 4th one since 2017, for €500m with a maturity of 5 years. This new sustainable bond enables Caisse des Dépôts to strengthen its presence on the capital markets, as well as its ESG signature, at the heart of the Group's global strategy.

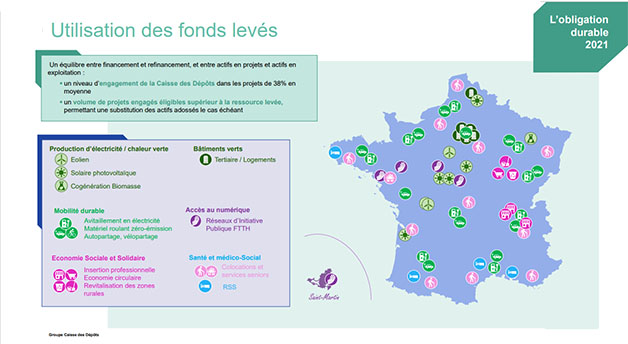

The funds raised will be used to finance green (59%) and social (41%) projects in key sectors :

- Infrastructure for the production and storage of green energy and heat;

- Green real estate ;

- Sustainable transport and mobility;

- Digital access ;

- Social and solidarity services ;

- Supporting the ageing of the population.

The order book attracted 72 investors in total. The new benchmark was issued at a spread of +13bp over interpolated French government bonds. The lead managers for this transaction were BNP Paribas, Deutsche Bank, La Banque Postale and Société Générale CIB.

This transaction is Caisse des Dépôts' fourth ESG issue, following an inaugural green bond in 2017, an inaugural sustainable bond in 2019 and a sustainable bond in 2020.

To find out more about the terms and conditions of the bond issue, read the press release (in French)

Know more about the Caisse des Dépôts' Green, Social and Sustainable Bonds

Crédit © Caisse des Dépôts