Given the climate emergency, the Group sets out its actions in a plan that supports the Paris Agreement. It assists local authorities and companies in their development towards:

- Releasing less carbon;

- Becoming more resilient to climate change;

- Taking local social issues (e.g. energy insecurity, energy conversion) caused by this transition into account.

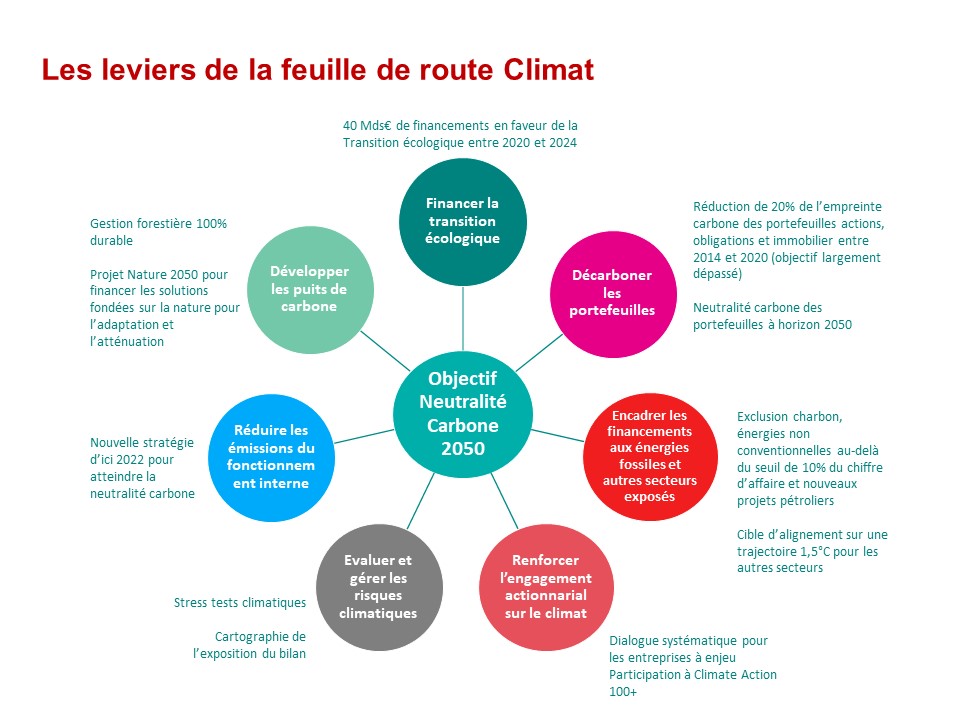

To this end, the climate policy of the Group’s financial activities simultaneously mobilizes all of our resources across our investment activities in order to encourage the gradual transition of the real economy towards carbon neutrality by 2050. According to IPCC scientists, this would make it possible to keep the global increase in temperature below 1.5°C.

There are overarching, demanding and regularly updated targets for each of these pillars.

Creating a collaborative dynamic to reach our shared ambition

Through our actions, we hope to encourage other institutional investors to act in a similar way and to share innovations and best practices with them. To this end, we are members of:

We are also members of various initiatives that allow us to exchange information with other actors such as management companies, issuing companies and public banks.

To find out more:

IIGCC : https://www.iigcc.org/

Mainstreaming climate action : https://www.mainstreamingclimate.org/

International Climate Initiative : https://www.franceinvest.eu/initiative-climat-international-ici

The Institute for Climate Economics (I4CE), which was launched in 2015 by Caisse des Dépôts and Agence Française de Développement (AFD), provides expertise to public and private decision makers on economic and financial issues related to ecological transition.

Transparent methods, activities and results

Complete and transparent annual publications

Our policy, as well as its implementation and results, is presented in the Annual Report on Sustainable Development and more specifically in the Responsible Investment Report, which in line with transparency requirements set out in French law relating to energy transition for green growth. Our aim is to gradually implement the recommendations of the Task Force on Climate Change Financial Reporting

Key figures

Developing the TEE finance offer

€12bn made available to TEE projects and companies between 2018-2019

61 new regions assisted through Ecological Transition Contracts (ETC)

Successful portfolio decarbonization

Carbon footprint 2014-2019: -43.5% shares, -66% corporate bonds, -24% property

Ongoing dialogue with financed companies to encourage them to address climate issues

2019: survey on climate risk vulnerability carried out among 73 listed companies in sectors that are vulnerable to climate risks. >2/3 of financed emissions covered.

Stricter and more transparent restrictions on funding the fossil industry

0 companies with more than 10% of their business activity in thermal coal financed

Responsible investor activity backed by a sustainable emissions policy

As an issuing member of the “Green Bond Principles” (GBP) and an observing member of the “Social Bond Principles”, Caisse des Dépôts respects the recommendations of these principles, particularly those concerning the use of external reviews and certifications. The issuance stands out due to its:

- Transparency regarding the characteristics of its Green, Social and Sustainable Bonds (asset selection criteria, project evaluation and selection procedures, management of funds raised).

- Reports regarding the implementation of commitments (proper allocation of funds, project compliance, ESG indicators).

Find out about Our Green, Social and Sustainable Bonds

Savings that finance sustainable projects

Thanks to deposits made to the Livret de développement durable et solidaire (LDDS), which are collected together in the mutual savings fund (Fonds d’Epargne), Banque des Territoires uses subsidized loans to finance:

- Energy renovation in social housing through the eco-loans

- Investments from local authorities in favour of energy and ecological transition through the Green Growth loan (no longer available since the end of 2017), which was replaced by the GIP AmBRE loan in 2018 and the Aqua Loan in 2019.

4200 projects in 1700 cities were financed by these Banque des Territoires loans, adding up to a total cost of €5.4bn, between 2014 to 2017 :

- 700 Green Growth loans, adding up to a total cost of €3bn

- 3,500 eco-loans (worth €2.4bn) to renew the heating systems of almost 200,000 social housing units.

Find out about the projects financed by your savings