Responsible finance

Placing ESG issues at the heart of financing

To boost the impact and limit the risks of our financing, we draw on five levers within the framework of the Responsible Finance Charter:

- Integration of ESG (environmental, social and governance) criteria in all investment and financing decisions.

- Shareholder engagement through dialogue with the portfolio company management teams.

- Norm- and sector-based exclusions.

- Controversy monitoring.

- ESG monitoring of our investments and financing.

Our target: Integration of ESG issues in 100% of our investments

ESG analyses, carried out before any investment decisions, are systematically presented to the investment committee.

Our target: 100% of our asset portfolios carbon-free by 2050*

Intermediate targets: reduction in the carbon intensity of the equity and corporate bond portfolio (in tCO2/€k) by 20% between 2020 and 2025 and by 55% between 2020 and 2030

*with targets every five years

In addition to this charter, the Group has adopted other policies based on priority issues

- Climate (including fossil fuels, real estate and transport)

- Nature

-

Download 2025 voting policy and principles of governance of listed companies PDF - 656 KB

-

Download Group anti-money laundering and terrorist financing policy [in French only] PDF - 174 KB

-

Download 2025 Group Code of Ethics [in French only] PDF - 911 KB

-

Download Responsible Finance Charter of CDC Group.pdf PDF - 1012 KB

A commitment throughout the period of ownership of the assets

We firmly believe that investors and lenders have a key role to play in supporting companies on ESG issues.

As an investor, our shareholder engagement is reflected in our regular dialogue with companies. Through dialogue, we aim to help companies advance their ESG commitments and verify the accuracy of their results. We make a special effort to monitor governance and climate challenges on any scale, as well as systematically voting at shareholders' meetings of the companies in which we hold shares.

For example, the Group implements rigorous shareholder dialogue with companies in the oil and gas sector and asks them for a transparent and scientifically credible transition strategy aligned with a 1.5°C scenario.

Our target: 100% of votes cast during shareholders' meetings.

Through dialogue, we aim to help companies advance their ESG commitments and verify the accuracy of their results, with particular effort being made to monitor governance and climate challenges.

Our 2024 key figures

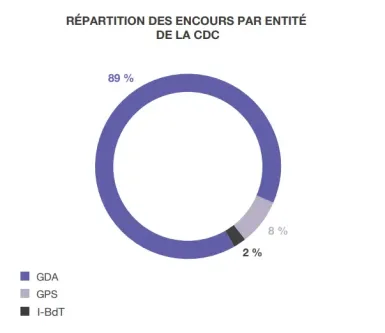

Breakdown of investments by asset class

©Caisse des dépôts

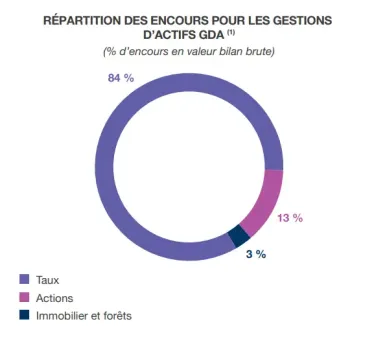

Breakdown of investments - Asset Management

©Caisse des Dépôts

Take a look at:

Download 2024 Responsible Investment Report PDF - 10.47 MB

Download 2025 voting policy and principles of governance of listed companies PDF - 656 KB

Download Voting results for 2025 shareholders' meetings [in French only] PDF - 1.34 MB

Download PRI - 2023 Public Transparency Report PDF - 1.73 MB