An integrated sustainable policy

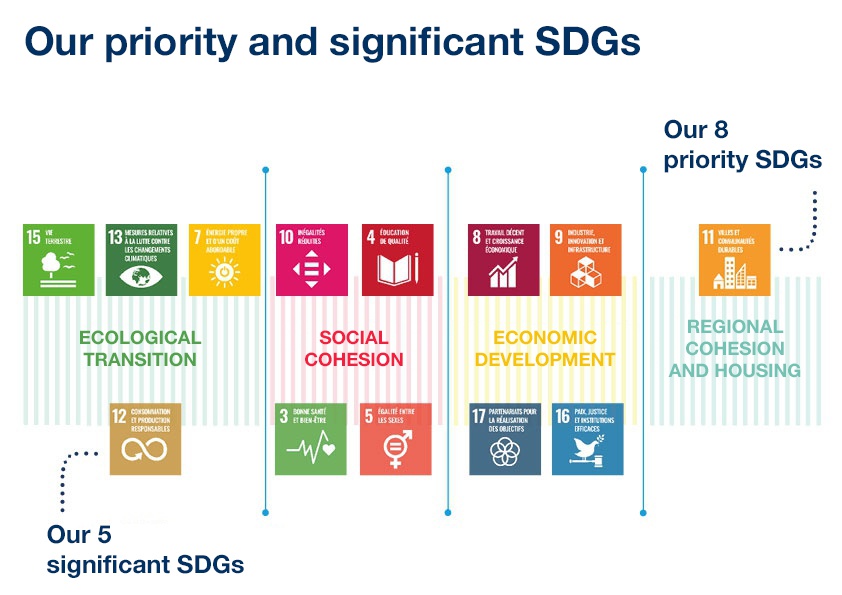

Our sustainable policy is broken down into four areas: accelerating the ecological transition, social cohesion, regional cohesion and contributing to the economic development of regions and companies.

It is rooted in our decision-making processes, from the most operational – such as selecting the projects we fund – to the most strategic processes – such as defining our Medium-Term Strategic Plan validated by our governing bodies (Executive Committee and Supervisory Commission).

It combines two approaches: incorporating the United Nations Sustainable Development Goals (SDGs) into our strategic management, and managing non-financial risks.

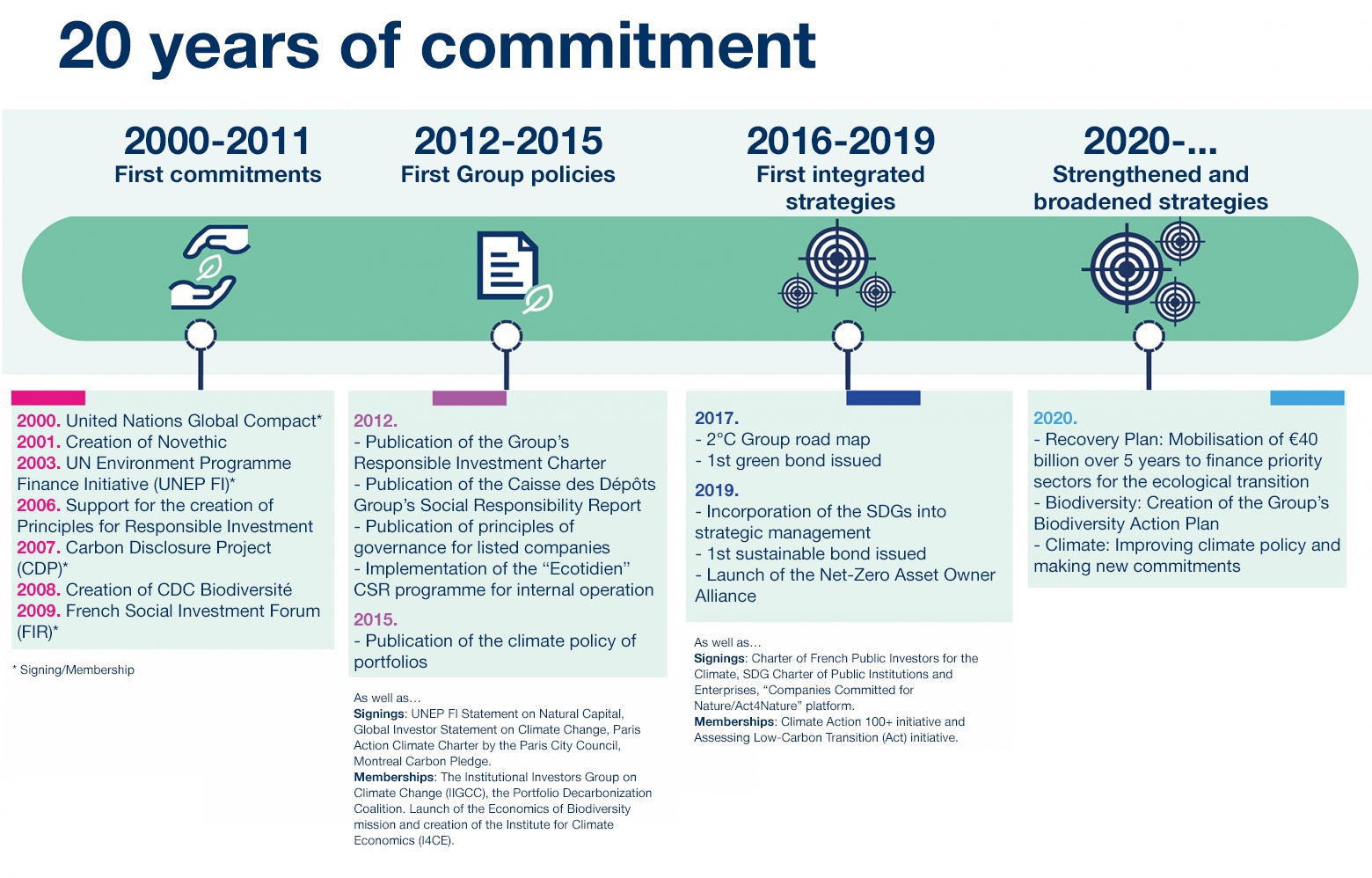

A long-established, recognised commitment

The Caisse des Dépôts Group, as a long-term investor, has been committed to more sustainable finance for over 20 years, and strives to be a driving force with other financial stakeholders through its participation in various coalitions of responsible financial players.

Our non-financial performance is thus recognised as one of the best among our peers and by the various non-financial rating agencies.

Commitments that aim for impact

To increase its positive impacts, monitor and realise its contribution to the United Nations Sustainable Development Goals (SDGs), the Caisse des Dépôts Group has drawn up a comprehensive roadmap.

The SDGs identified as Group-wide priorities have quantifiable targets and action plans implemented within its departments.

This could, for example, concern the number of social housing units financed, new production capacities from renewable energy sources, the CO2 emissions in our asset portfolios or increased funding for specific projects (health, education, digital, environment, etc.)

Our goals today

For the ecological transition

- Financing the transition to a low-carbon economy and restricting funding for high-emission sectors

- Developing products and services with a positive impact on the environment

- Assessing and controlling climate risks

- Neutralising our impacts on biodiversity

For social cohesion

- Supporting the education, healthcare and elderly care sectors

- Developing inclusive service offerings with a positive social impact

- Being a socially responsible employer

For inclusive economic development

- Financing companies and supporting the development of SMEs, microenterprises and intermediate-sized enterprises, particularly in fragile areas

- Supporting innovation

- Developing sustainable infrastructure

For regional cohesion

- Financing local authorities in their land use planning and sustainable city projects

- Financing decent housing for all

- Working to reduce regional inequalities (digital divide, access to public services, etc.)

Faced with a state of climate emergency and the accelerating destruction of biodiversity, Caisse des Dépôts is taking action through stronger commitments for the climate and biodiversity. Our commitments to the SDGs are subject to detailed reporting in our activity and sustainable development report.

Find out more about our commitments

Giving priority to consultation, monitoring and transparency

Our CSR approach has always been based on ongoing dialogue with our stakeholders and a desire for transparency:

-

A stakeholder committee bringing together experts, NGOs, local government associations, associations of savers and SMEs meets twice a year in the presence of our Chief Executive Officer and members of the Executive Committee in order to review our commitments with regard to sustainable policy;

We draw up an integrated report that is consolidated at Group level – this constitutes the primary financial and non-financial management tool for our performance;

Publications provide a voluntary response to the Declaration of Non-Financial Performance (DPEF), in compliance with the requirements of Article 173.6 of the Act on Energy Transition for Green Growth (TECV), as amended by the Act on Energy and Climate.

Download the reports

In addition, several subsidiaries and shareholdings publish their own non-financial report:

- CSR publications and releases BPIfrance

- CSR publications and releases Compagnie des Alpes

- CSR publications and releases Egis

- CSR publications and releases Icade

- CSR publications and releases CDC-Habitat

- CSR publications and releases Transdev

- CSR publications and releases CNP Assurance

- CSR publications and releases La poste