Our issuance programs

Caisse des Dépôts has access to the short, medium and long-term markets through dedicated programmes.

The issuances from Caisse des Dépôts have the following qualities:

- 0% rick weighting for bank capital adequacy purpose (Bâle III)

- Liquidity Coverage Ratio confirmed at level 1

- Eligible for the Asset Purchasing Expanded Programme from the European Central Bank

The Global Commercial Paper programme with a ceiling of 30 billion euros

- Euros Commercial Paper (ECP): Multicurrency English law programme from 1 year to 1 year less 1 day. Fixed rate issuances.

- US Commercial Paper (USCP): American law programme in dollars for 1 day to 397 days. Fixed rate issuances or floating ones against SOFR USD .

The «Negotiable European Commercial Paper » program (NEU CP) of 20 billion euros

- Multicurrency French law programme, from 1 day to 1 year,

- Fixed rate or floating rate issuances

The EMTN programme of 25 billion euros for public or private issuances

- Private placement over a very wide range of currencies: EUR, USD, GBP, JPY, HKD, AUD, NOK, CZK, etc.

- Public "benchmark" in USD, GBP, CHF, JPY and EUR

- The capital is guaranteed for the investor.

The « Negotiable European Medium Term Note » program (NEU MTN) of 1.5 billion euros

2025

| Year | Month of primary issuance | Name | Rate type | Rate | Notional amount | Currency | Maturity | ISIN code |

|---|---|---|---|---|---|---|---|---|

| 2025 | January | TF | 4,63% | 1,250Md | USD | 31/01/2028 | FR001400X0A6 | |

| 2025 | February | TF | 2,78% | 15M | EUR | 11/02/2030 | FR0128910504 | |

| 2025 | February | TF | 5,2727% | 20M | AUD | 17/02/2040 | FR001400XDA5 | |

| 2025 | February | TF | 3,125% | 1000M | EUR | 25/05/2035 | FR001400XFB8 | |

| 2025 | February | TF | 2,69% | 10M | EUR | 19/02/2029 | FR0129060606 | |

| 2025 | February | TF Callable | 3,33% | 50M | EUR | 27/02/2035 | FR001400XRG2 | |

| 2025 | February | TF | 0,8100% | 200M | CHF | 27/02/2030 | CH1414003520 | |

| 2025 | February | TF Callable | 3,8910% | 50M | EUR | 26/02/2045 | FR0129060622 | |

| 2025 | February | TF Callable | 6,46% | 45M | USD | 24/02/2045 | FR001400XJF1 | |

| 2025 | May | TF | 0,93% | 110M | CHF | 07/05/2032 | CH1433241135 | |

| 2025 | May | TF Callable | 5,98% | 25M | USD | 27/052045 | FR001400ZYW0 | |

| 2025 | May | TF | 4,25% | 500M | GBP | 28/02/2028 | FR001400ZY21 | |

| 2025 | May | TF Callable | 3,914% | 50M | EUR | 28/05/2045 | FR0129208734 | |

| 2025 | May | TF Callable | 3% | 15M | EUR | 28/05/2032 | FR00140101S9 | |

| 2025 | June | TF | 2,255% | 25M | EUR | 06/06/2028 | FR0014010633 | |

| 2025 | June | TV | EURIBOR3M+106bp | 25M | EUR | 25/06/2035 | FR0014010OL1 | |

| 2025 | June | TV | EURIBOR3M+92bp | 25M | EUR | 25/06/2035 | FR0014010OK3 | |

| 2025 | June | TF | 2,64% | 25M | EUR | 26/06/2030 | FR0014010UG8 | |

| 2025 | June | TF Callable | 3,12% | 50M | EUR | 27/06/2033 | FR0014010UK0 | |

| 2025 | June | TF Callable | 4,41% | 40M | EUR | 27/06/2050 | FR0014010UL8 | |

| 2025 | July | TF | 4,02% | 30M | EUR | 18/07/2050 | FR0014011BF8 | |

| 2025 | July | TF | 4,75% | 25M | EUR | 18/07/2050 | FR0014011B22 | |

| 2025 | July | TF | 6,142% | 40M | USD | 28/07/2045 | FR0014011BS1 | |

| 2025 | October | TF | 2.75% | 1000M | EUR | 16/10/2030 | FR0014013G74 | |

| 2025 | October | TV | E3M +85 bp CAP 4,5% Floor 1,5% | 30M | EUR | 17/10/2034 | FR0014013I31 |

2024

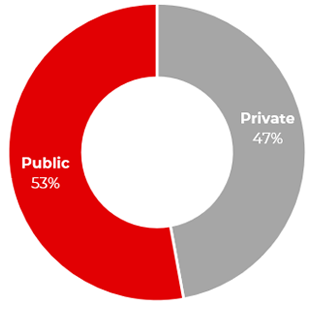

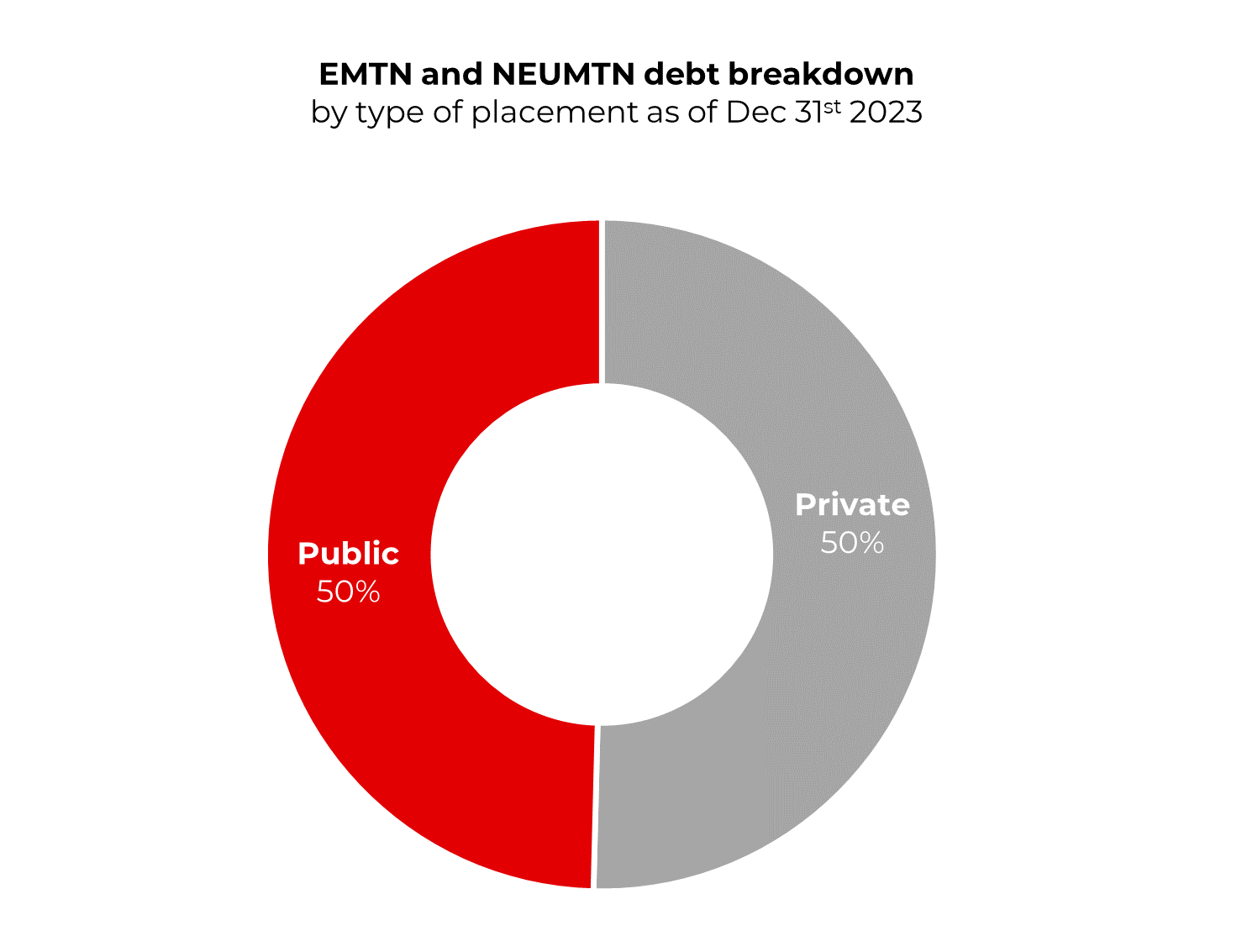

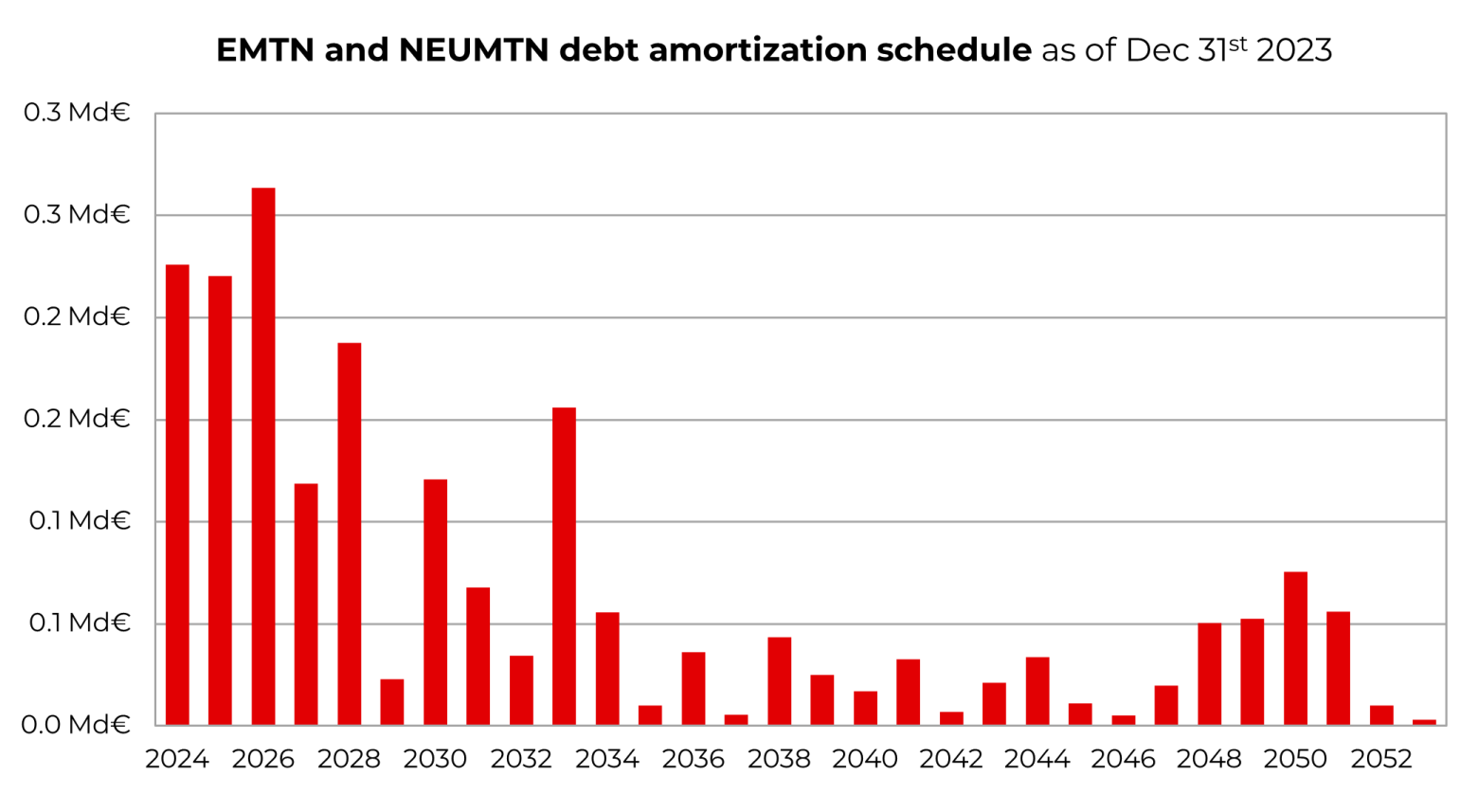

EMTN and NEUMTN debt breakdown

by type of placement as of June 30th 2024

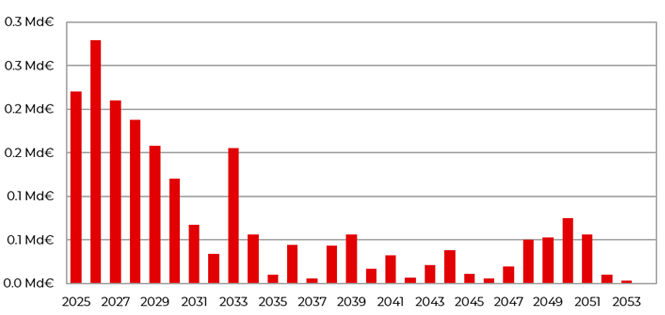

EMTN and NEUMTN debt amortization schedule

as of June 30th 2024

| Year | Month of primary issuance | Name | Rate type | Rate | Notional amount | Currency | Maturity | ISIN code |

|---|---|---|---|---|---|---|---|---|

| 2024 | January | TF | 1,554% | 150M | CHF | 16/01/2026 | FR001400N897 | |

| 2024 | January | TF | 4,00% | 300M | GBP | 17/01/2029 | FR001400N7L0 | |

| 2024 | January | TF Callable | 3,60% | 50M | EUR | 25/01/2036 | FR001400NHQ3 | |

| 2024 | January | TF | 4,25% | 1000M | USD | 31/01/2027 | FR001400NJA3 | |

| 2024 | April | TV | ESTR + 41 bp | 15M | EUR | 30/04/2036 | FR001400PTR1 | |

| 2024 | May | TF | 3,00% | 1000M | EUR | 25/05/2029 | FR001400PU76 | |

| 2024 | May | TF | 1,500% | 100M | CHF | 24/05/2039 | CH1321508330 | |

| 2024 | May | TF Callable | 3,900% | 10M | EUR | 14/05/2046 | FR001400PZW8 | |

| 2024 | May | TF Callable | 3,870% | 100M | EUR | 30/05/2039 | FR001400Q7L7 | |

| 2024 | May | TV | ESTR + 44 | 10M | EUR | 30/05/2039 | FR001400QCF0 | |

| 2024 | May | TV | ESTR + 42 | 10M | EUR | 29/05/2036 | FR001400QCG8 | |

| 2024 | May | TF Callable | 3,838% | 100M | EUR | 31/05/2039 | FR001400QD50 | |

| 2024 | May | TF Callable | 5,550% | 10M | USD | 31/05/2036 | FR001400QDV5 | |

| 2024 | June | TF Callable | 5,44% | 50000000 | USD | 24/06/2044 | FR001400QTR9 | |

| 2024 | June | TV | Euribor 3M + 56bp | 10000000 | EUR | 27/06/2034 | FR001400QZ13 | |

| 2024 | July | TF | 5,17% | 100M | AUD | 19/07/2039 | FR001400R3D2 | |

| 2024 | July | TV | ESTR + 52 | 10M | EUR | 22/07/2036 | FR001400RJL1 | |

| 2024 | July | TF | 0,749% | 30Md | JPY | 31/07/2029 | FR001400RSG2 | |

| 2024 | August | TF | 0,9925% | 150Md | CHF | 23/09/2030 | CH1360612472 | |

| 2024 | September | TF | 4% | 250M | GBP | 22/07/2027 | FR001400SML3 | |

| 2024 | September | TV | ESTR + 45,5 | 50M | EUR | 19/09/2034 | FR001400SRV1 | |

| 2024 | September | TV | EURIBOR3M+65bp | 10M | EUR | 20/09/2034 | FR001400SRU3 | |

| 2024 | October | TV | SOFR + 42,5 bp | 20M | USD | 18/10/2027 | FR001400TCQ1 | |

| 2024 | October | TF | 4,47% | 150M | USD | 21/10/2031 | FR001400TB26 | |

| 2024 | October | TF Callable | 5,71% | 35M | USD | 24/10/2044 | FR001400TKP6 | |

| 2024 | November | TF | 3,33% | 100M | EUR | 07/11/2034 | XS2615318016 | |

| 2024 | November | TF | 4,62% | 40M | USD | 20/12/2031 | FR001400USU7 |

2023

| Year | Month of primary issuance | Name | Rate type | Rate | Notional amount | Currency | Maturity | ISIN code |

|---|---|---|---|---|---|---|---|---|

| 2023 | January | EMTN EUR TF 2,80% 16/01/2026 FR001400F2O5 S360T1 | TF | 2,800% | 100M | EUR | 16/01/2026 | FR001400F2O5 |

| 2023 | January | TF | 3,100% | 15M | EUR | 12/01/2033 | FR001400F3K1 | |

| 2023 | January | TF | 3,161% | 75M | EUR | 12/01/2033 | FR0127695544 | |

| 2023 | January | TF | 4,250% | 1Md | USD | 20/01/2026 | FR001400F638 | |

| 2023 | January | TF | 3,095% | 10M | EUR | 19/01/2038 | FR001400F901 | |

| 2023 | January | TF Callable | 3,620% | 10M | EUR | 19/01/2038 | FR001400F919 | |

| 2023 | January | TF Callable | 3,220% | 15M | EUR | 20/01/2033 | FR001400FA56 | |

| 2023 | February | TF Callable | 3,230% | 29M | EUR | 01/02/2033 | FR001400FE94 | |

| 2023 | February | TV | Euribor6M+42 | 25M | EUR | 01/02/2043 | FR001400FG01 | |

| 2023 | January | TF | 1,740% | 30M | CHF | 27/01/2053 | FR001400FH26 | |

| 2023 | February | TF | 1,750% | 100M | CHF | 24/02/2031 | CH1249151049 | |

| 2023 | February | TF | 5,090% | 50M | AUD | 14/02/2038 | FR001400FTM3 | |

| 2023 | February | TF Callable | 3,530% | 13M | EUR | 21/02/2035 | FR001400FTT8 | |

| 2023 | February | TF | 3,125% | 1Md | EUR | 25/05/2033 | FR001400FTZ5 | |

| 2023 | February | TF | 1,183% | 114M | EUR | 25/05/2031 | FR0013164530 | |

| 2023 | April | EMTN EUR TF 2,66% 17/04/2026 FR001400HDM3 S373T1 | TF | 2,660% | 100M | EUR | 17/04/2026 | FR001400HDM3 |

| 2023 | May | TV | SOFR + 34 bp | 600M | USD | 03/05/2026 | FR001400HOV1 | |

| 2023 | May | TF | 4,500% | 325M | GBP | 26/08/2025 | FR001400I3H4 | |

| 2023 | May | TF | 3,000% | 500M | EUR | 25/05/2028 | FR001400I3M4 | |

| 2023 | August | TF Callable | 3,450% | 10M | EUR | 08/08/2033 | FR001400K5F9 | |

| 2023 | September | TF Callable | 4,10% | 50M | EUR | 21/09/2038 | FR001400KO79 | |

| 2023 | Octobre | EMTN EUR TF 4,4% 10/10/2043 FR001400L9W5 S379T1 | TF Callable | 4,40% | 10M | EUR | 10/10/2043 | FR001400L9W5 |

| 2023 | Octobre | TF | 3,38% | 500M | EUR | 25/11/2030 | FR001400LFC1 | |

| 2023 | Décembre | TF | 5,49% | 50M | AUD | 15/12/2038 | FR001400MMU7 |

Green, Social and Sustainability Bonds

Caisse des Dépôts has been a regular issuer on the ESG funding market since 2017.

Our vocation is to accompany the structuring of the sustainable finance market and as such to promote its best practices.

Our commitment is to maintain a regular presence on the ESG market by issuing 1 billion euros in Green, Social or Sustainability Bond benchmark per year. Find in this section all the documents dedicated to Caisse des Dépôts' Sustainability Bonds since 2017:

- Frameworks and Second Party Opinions

- Annual allocation and impact reports

- Auditor’s report

- Investor presentations for Sustainability Bonds

In order to meet our commitments, and finance projects with environmental and social benefits, we have created a Sustainable Bond Framework, under which we can issue Green, Social and Sustainability Bonds.

All our frameworks have been certified by Second Party Opinions, delivered by Vigeo Eiris until 2019, and then by Moody’s in 2022 and 2023.

Caisse des Dépôts is committed on a given frequent and qualitative reportings in line with the highest requirements of international standards and will provide investors annually and until bond maturity :

- reports on the allocated proceeds to the eligible assets ;

- relevant impact metrics, as well as the methodology and assumptions used to calculate these metrics.

Caisse des Dépôts publishes an exhaustive and nominative list of financed projects. For each eligible category, the number of projects, the average share of Caisse des Dépôts financing, the invested amounts as well as the refinancing and co-financing shares is detailed in a table.

The Statutory Auditor of the Caisse des Dépôts Group will certify the effective allocation of proceeds to eligible assets, as well as the conformity of these assets with the eligibility criteria. The review is carried on an annual basis following the final allocation decision from the Commitee and until the bonds' maturity.

Latest Financial statements and Ratings

Caisse des Dépôts, french public financial institution, is a state agency.

Two laws grant it's highly protective status.

Caisse des Dépôts benefits from the same rating as the French state.

- Immunity to liquidation and bankruptcy (French law of 25 January 1985 - art L 631-2 and L 640-2 of the French commercial code)

- Solvency protection: French Law 80-539 of 16 July 1980.

Ratings: Reports from Fitch, Moody's and S&P's, rating agencies

| Notations | Standar & Poor's | Moody's | Fitch |

|---|---|---|---|

| Caisse des Dépots | AA-/A-1+ | Aa3/P-1 | A+/F1+ |

| EMTN & BMTN Programmes | AA- | Aa3 | A+ |

| CD Programme | A-1+ | P-1 | F1+ |

| Global CP Programme | A-1+ | P-1 | F1+ |

Our videos and investor presentations

A presentation updated every month, describing the missions and key elements of Caisse des Dépôts, as well as its financial and extra-financial profile as part of its activity as a bond issuer.

- Legal status and governance

- CDC Group activities

- Focus on the issuer: Central Sector of CDC

- Funding strategy

- Activities on behalf of the French State

What is the purpose of Caisse des Dépôts group ?

Funding Programme

Our sustainability commitents and issuances

Our investor and ESG libraries

In our investor library, find the history of our issuance programs, our issuances’ Final Terms as well as our annual accounts and analysis.

In our ESG library, find all our reports, policies, guidelines and other documents regarding Caisse des Dépôts' commitments in terms of sustainable development and corporate responsibility.

Your contacts

Short-term treasury

- Stephan Haeuw

Head of Short-term Issuances treasury - David Reymond

Deputy Head of Short-term Issuances treasury - Julie Penven

Cash Manager - Audrey Bonnet

Cash Manager

Short Term Desk

Email : CDC.TREASURY

Tel : +331.58.50.21.67

Reuters Dealing Code : CDCP

Long-term financing

- Thibaud Grimard

Head of Financing, Loans and Engineering - Rania Alili

Financing, Loans and Engineering - Hélène Pancrazi

Financing, Loans and Engineering - Head of Loans - Pierre Martin-Djian

Financing, Loans and Engineering - Hoa Cassagne

Financing, Loans and Engineering

Long-term Desk

Email : EMTN-CDC

Tel : +331.58.50.22.58

Bloomberg : CDCEPS <Govt> <Go>

Back Office Securities

Email : DEOFIL-FLUX-VALEURMOBILIERE

Back Office FX and OTC Derivatives

Email : LD-DEOFIG-OTC